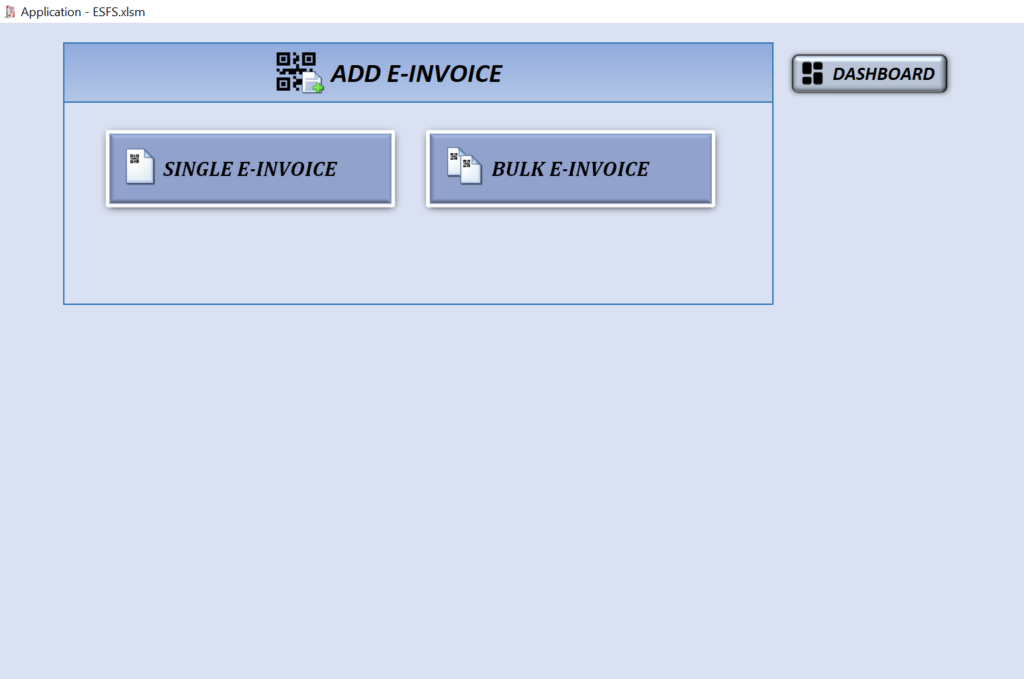

E-Invoicing Software for Services Business – ESFS

ESFS – Einvoicing Solution for All Business Needs

- Easy Installation within 2 Minutes

- Fully Offline

- Only MS-Excel Required

- No Need of API

- No Need of GSP

- Add Upto 1000 Items in Single E-Invoice

- No Limit of E-Invoice Generation

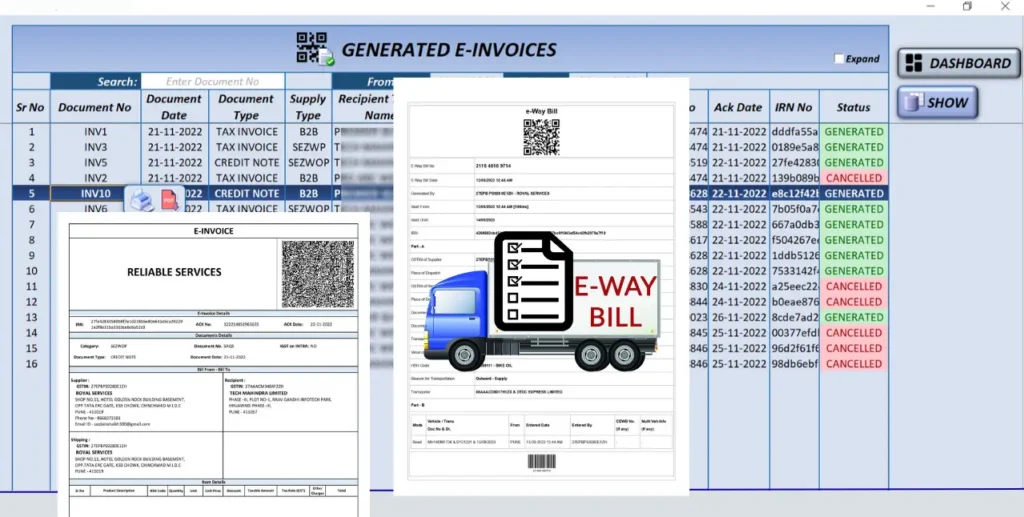

- E-Way Bill Generation

- 15 Days Money Back Guarantee

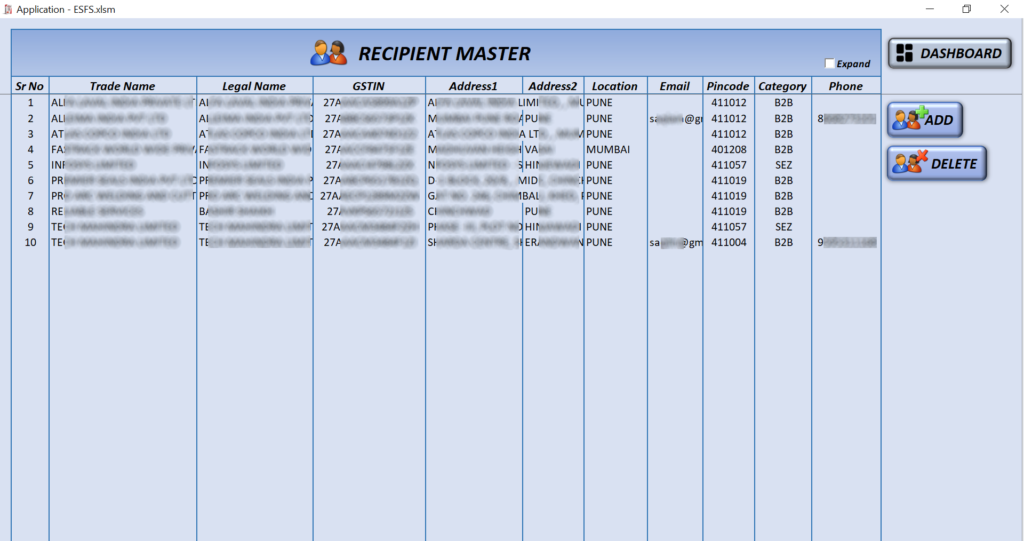

ESFS is Specially Designed for None ERP or SAP Users

Simple Dashboard and Fully Offline Software - No Internet Connection Required, till Json Upload.

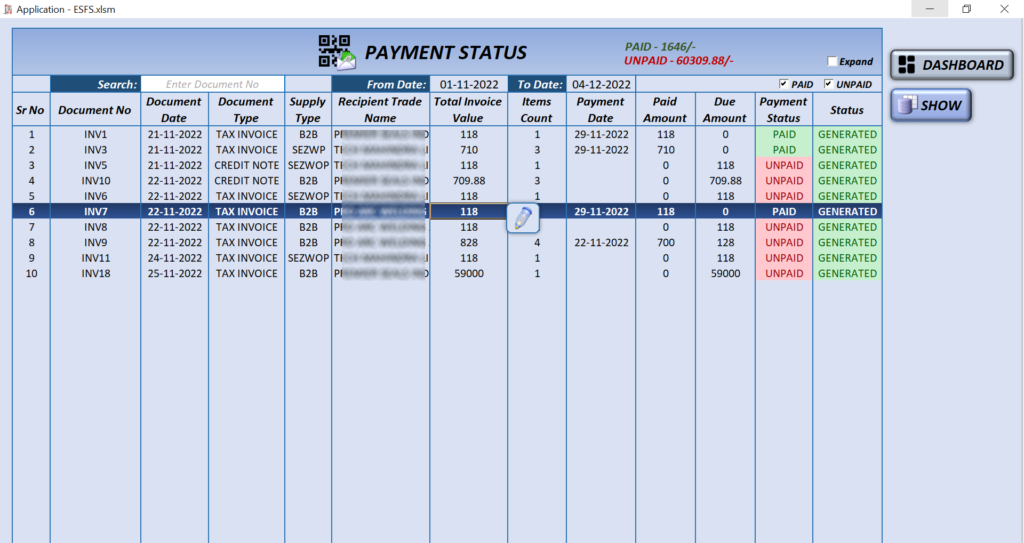

ESFS provide simple and clean dashboard for better user experience,

*Most Important in this on going competition nothing is important than your Database, So in this case ESFS provide you E-Invoice Offline Solution.*

Without ESFS

- Need to Change your Existing Software

- Database Saved Online

- Complicated Installation

- Extra GSP Charges

- E-Invoicing activation charges 15k - 25k

- 15 - 35 Paisa Per E-Invoice Generation

With ESFS

- No Need to Change your Existing Software

- Complete Offline Software, No Scarcity of Database Privacy.

- Easy Installation Within 2 Minutes

- No GSP Charges

- Unlimited Free

- Unlimited Free

*Don't need to change your Existing Software, Just Print the E-Invoice Header Page with ESFS and attach it to your existing software invoice Print*

* ESFS is digital Signed by Code Signing Certificate issued by Sectigo Public Code Signing CA R36*

WHAT OUR CUSTOMERS ARE SAYING

ESFS Full Demo on Youtube

15 Days Free Trial

Contact us

- Phone - +91-9049043694

- Email - [email protected]

Frequently Asked Questions (FAQ's)

E-Invoicing depicts the system in which business-to-business (B2B) creates invoices digitally, and the Goods and Services Tax Network (GSTN) verifies them.

The e-Invoicing system allows the IRP(Invoice Registration Portal), managed by the GSTN(GST Network), to assign an identification number to each invoice. The e-Invoice portal sends all invoice information to the GST and e-way bill portals in real time.

From October 1, the centre has made e-Invoicing mandatory for businesses with an aggregate turnover of more than Rs 10 crore. The amendment would plug revenue leakage and ensure better tax compliance from businesses. You currently require e-Invoices if your annual turnover exceeds Rs 20 crore.

Your businesses will benefit from e-Invoicing in the following ways:

- Limited Errors: e-Invoicing in GST resolves and plugs a significant gap in GST data reconciliation and reduces errors. e-Invoices lessen the need for manual inputs and improve automation. It enables interoperability and minimises data entry errors compared to paper-based invoices.

- Easy Invoice Tracking: The e-Invoicing software determines the time of sending, viewing, and paying an invoice and thereby helps real-time invoice tracking.

- Reduced Tax Evasion: e-Invoicing software allows real-time access to invoice data and facilitates the availability of genuine input tax credit. Hence reduces the possibility of invoice manipulation.

- Data Integrity: e-Invoices certify the legitimacy of audits and surveys since the tax authorities can find the information needed at the transaction level.

Half has reduced the turnover limit for e-Invoicing to Rs 10 crore, effective 1tst October 2022, under the GST regime.

Not yet.If you have a turnover limit of Rs 5 crore or more, you must generate an e-Invoice only from January 2023, per the CBIC. The motive of the initiative is to increase compliance and policymaking.

The data on the IRP will be available for only 24 hours. However, once an invoice is registered and validated, it is uploaded into the relevant GST return. Also, it is available for the entire fiscal year.

No. According to Rule 48(5), any invoice issued by a person to whom the provisions of e-Invoicing apply that is not an e-Invoice is invalid.

As per the new threshold on e-Invoicing for businesses by the government of India that goes into effect on October 1, the mandatory turnover threshold has been lowered to Rs 10 crore from Rs 20 crore. Hence, e-Invoicing will be mandatory for enterprises with an e-Invoice turnover limit of Rs 10 crore.However, e-Invoicing does not apply to the following registered persons, regardless of turnover, as specified in CBIC Notification No.13/2020-Central Tax:

- An insurer or a financial institution, or a banking company (NBFC-included)

- A GTA(Goods Transport Agency)

- A registered person who supplies service for passenger transport

- A registered person who supplies services such as admission to the exhibition of cinematographic films in multiplex services

- An SEZ unit

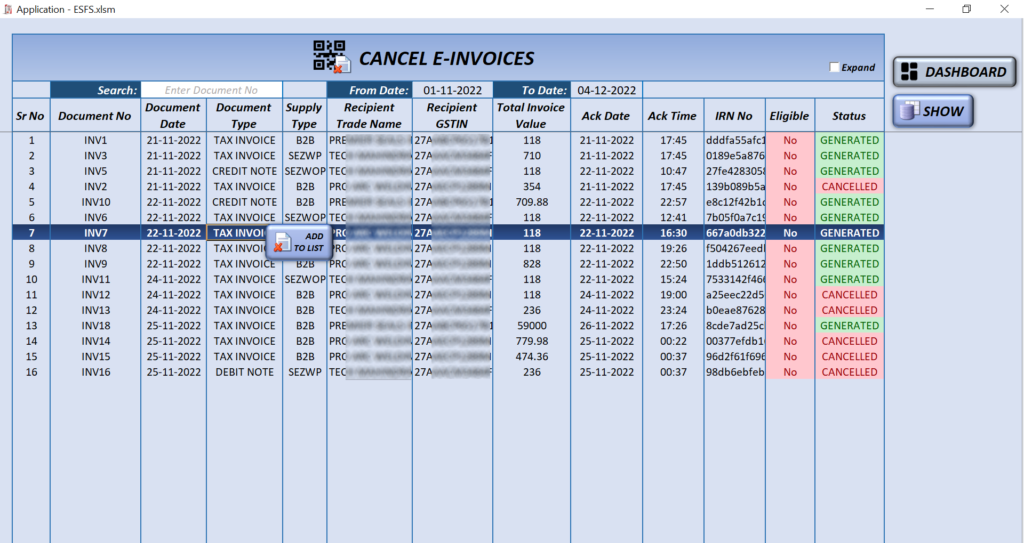

When you generate an e-Invoice:-

- You would receive a government-generated e-Invoice document that contains the following information –

- Acknowledgement no

- Acknowledgement date

- IRN no

- QR Code

- You would receive an e-Invoice login update on the GST portal.

- Your corresponding buyers get an update on their GSTR2A report on the portal.

Copyright © 2022 Reliable Technologies | Privacy Policy | TOS